Dealing with the sensitive matters of getting more involved with helping parent (s) plan when they are ageing.

Due to overwhelming requests from families who want to help, but are struggling to manage their ageing parents, I am pleased to have built and now launched the Elderplan support package which is now available on subscription. Simply contact us directly.

Due to overwhelming requests from families who want to help, but are struggling to manage their ageing parents, I am pleased to have built and now launched the Elderplan support package which is now available on subscription. Simply contact us directly.

The package is specifically for families or advisers to be able to effectively support older family members and help them maintain the highest possible quality of life, for the longest possible time.

This planning helps deal with some of the bigger issues faced by the elderly, such as exposure to elder abuse, residential aged care, and loss associated with the incapacity or passing of a loved partner.

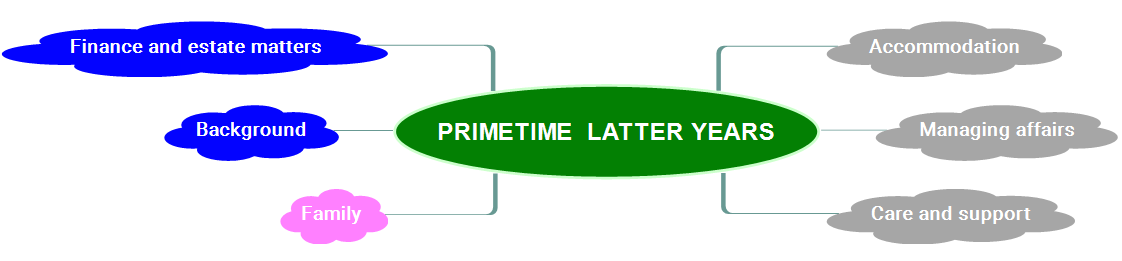

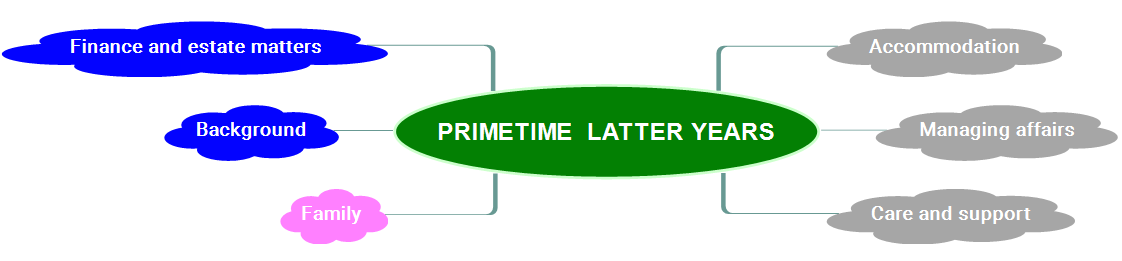

The package adopts the holistic “Primetime” approach covering the matters set out below. Planning includes the full suite of Primetime tools and functions such as the personal reports, live online action planner, electronic filing cabinet, tools, checklists and referral service.

The plan works on the key premises of Evaluation > Engagement > Empowerment

Evaluation by family-What are the current circumstances and feelings. Needs, family dynamics, communications, current status, knowledge, exposure and vulnerability.

Engagement- Working on the dialogue to get the ball rolling. The biggest issues can be reluctance from a parent to accept help. The process involves discussion and agreement, between parents and children, across siblings, and with others.

Empowerment-Taking action, determine who does what, coordinating, and covering all bases

If you want to understand what is in the Primetime system and how to use it, send a request for a link to the Primetime Youtube Channel where you can view each of the separate videos. There are 30 videos all covering how to use the system, each of the different aspects and tools.

If you want to understand what is in the Primetime system and how to use it, send a request for a link to the Primetime Youtube Channel where you can view each of the separate videos. There are 30 videos all covering how to use the system, each of the different aspects and tools.

Due to overwhelming requests from families who want to help, but are struggling to manage their ageing parents,

Due to overwhelming requests from families who want to help, but are struggling to manage their ageing parents,