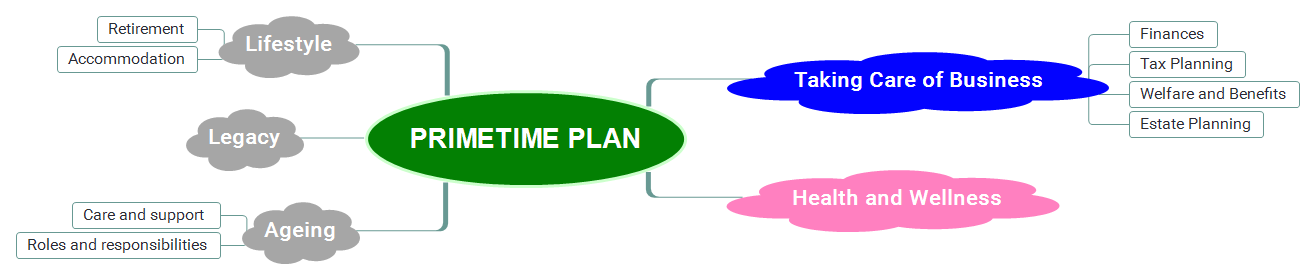

Primetime planning goes way beyond traditionally saving money for retirement. Primetime planning covers whole of life planning through separate but linked components. Each of the components can be addressed separately and revised when your circumstances change (which they inevitably do..... constantly).

Lifestyle

Lifestyle planning is about LIFE CHOICES and it is based on values. We recommend doing this as a first step as it will play an integral part of other decisions including important financial choices.

- Retirement

- Accommodation

Finishing work or business is a significant life changing event. The change creates the opportunity to revisit what is important in life, identify and clarify your defining values, and then design your life around these values.

The family home is both financially and emotionally significant making longer term forward planning a must and planning shouldn't be done without including financial matters and ageing considerations.

Taking care of Business

In order to enjoy peace of mind through life, having well managed financial and estate matters is paramount. With this mind the Primetime Plan covers the following aspects:

- Finance

- Estate Planning

- Tax Planning

- Welfare and benefits

Managing money and assets forms a cornerstone of planning in retirement and allows for better decisions.

The Primetime finance component deals with three key factors:

Recurring money coming in-how much income you have to spend

Costs-long term estimating and budgeting for living costs, major costs and fun stuff

Assets and debts-what future assets are available to draw on to finance living and what might be able to be passed on

Up to date Estate planning is vital for a number of reasons

Firstly, if you should become incapacitated either temporarily or permanently, then someone or a number of people will need to take over the management of your affairs.

Secondly, if you want to ensure that your wishes are adhered to then appropriate legal documentation needs to be prepared.

Thirdly, circumstances change which need to be addressed otherwise estate planning can be not effective.

Finally, estate planning needs to be communicated and documentation needs to be valid and accessible.

Primetime planning ensures your estate planning is complete, up to date, and accessible.

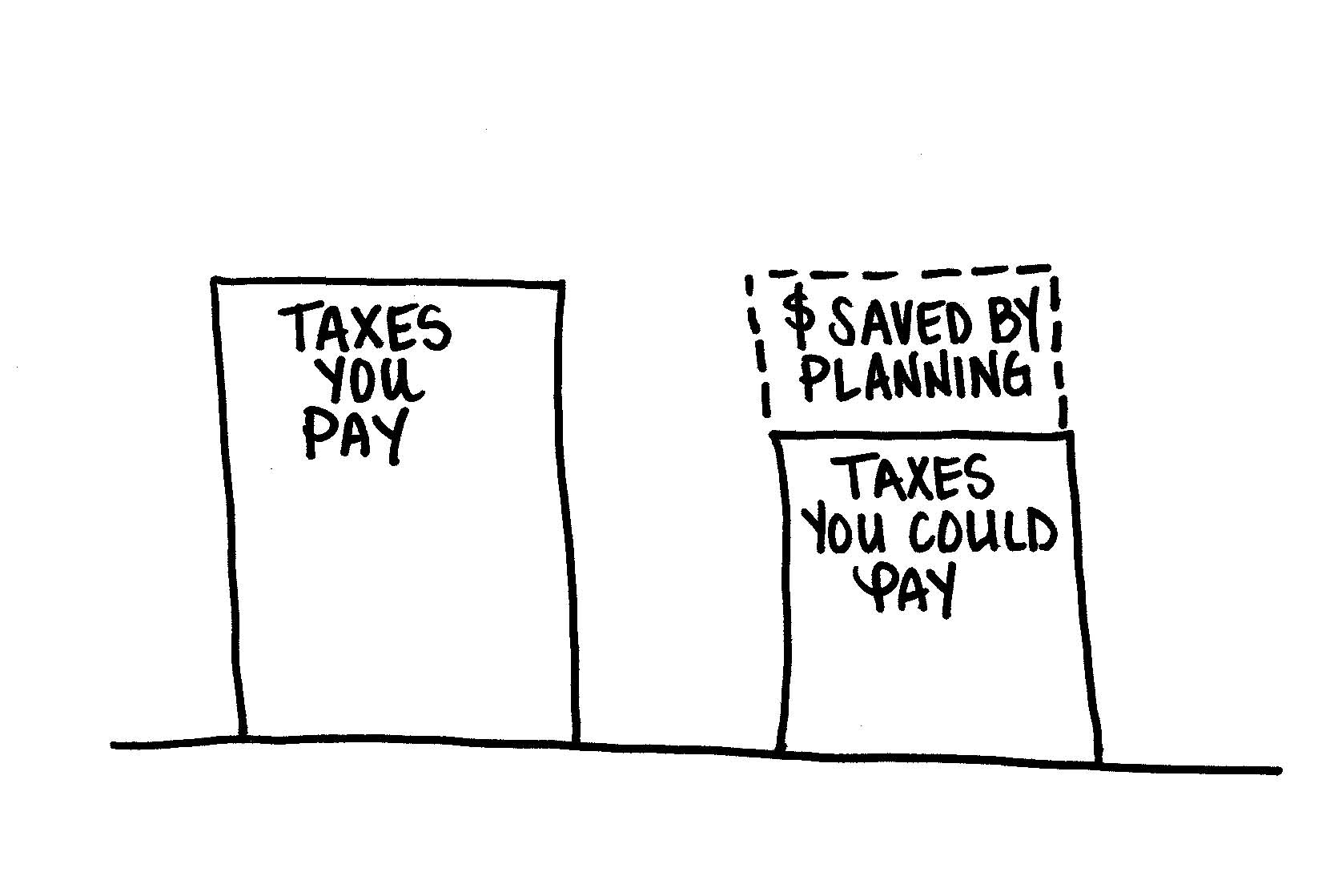

Tax on earnings impacts what is available for spending and the after tax value of an asset is its real value in terms of cash generation.

When people evaluate their wealth for the purpose of planning, they often ignore the tax consequences of options they are reviewing. This can cost up to 50% (or more) of revenue and gains.

Long term tax planning can significantly minimise tax whilst living and for estate planning on passing.

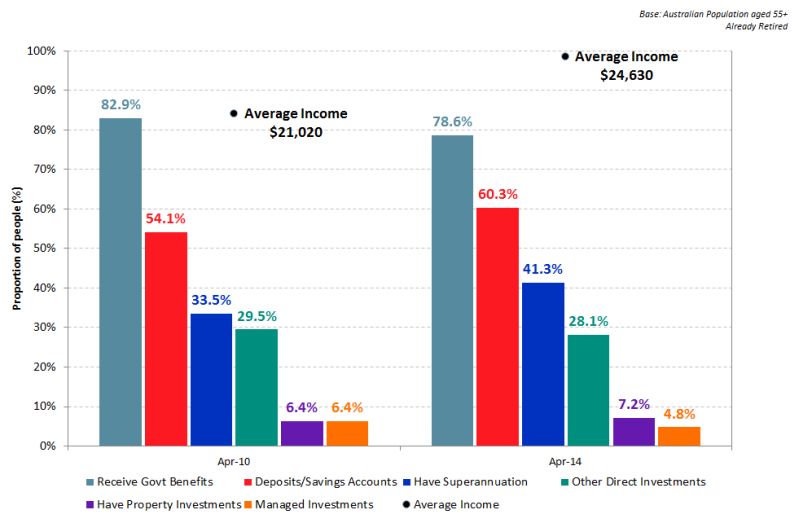

Research in Australia shows around 80% of retirees over 55 receive government benefits.

http://www.roymorgan.com/findings/5679-most-retired-australians-receive-government-benefits-201407110207

The accessibility to government funded welfare and benefits is a significant financial factor for retirees over the expected 20 years of life expectancy after retirement age. This includes means tested costs of care and support in the latter years of life.

This complex and bureaucratic aspect of planning needs to be undertaken together with financial planning and tax planning to maximise benefits and minimise costs.

Health and Wellness

Quality and enjoyment of life is usually measured by the feeling of wellness and a sound mental state.

Primetime places importance on proactively managing physical and mental health and recognises three levels of health prevention as explained below.

- Primary prevention

- Secondary prevention

- Tertiary prevention

Lifestyle choices that enhance health and well being. This involves being proactive and structured around diet and exercise.

It is widely accepted that this is the cheapest and most effective way of maintaining strength, flexibility, lowering symptoms of chronic disease and maintaining strong mental health.

The world health organisation estimates that every $1 spent on moderate physical exercise saves over $3 in medical costs.

Undetected, pre existing health issues are a ticking time bomb. Early detection through regular testing can provide better health outcomes as treatment can commence once detected.

Early screening enables early detection of chronic disease and disability. Just because there are no symptoms and we feel healthy this doesn't mean there is no issue.

The genetic lottery does not discriminate.

This is aimed at medical treatment for recovery, rehabilitation or management of illness.

The planning objective is to reduce reliance on tertiary prevention through a focus on primary and secondary prevention.

The world health organisation estimates that every $1 spent on moderate physical exercise saves over $3 in medical costs.

Legacy

Planning your legacy is something that is very powerful and can provide purpose and meaning . It shouldn’t be mistaken with having a will, It’s more than that. It is about how you might be remembered long after passing.

- Legacy

Leaving a legacy comes from reflection, thinking and feeling.

Primetime planning stimulates thought for those that are ready to look to the heart and focus the mind. For some it becomes a quest, and for others it will never occupy a conscious thought, never become front of mind.

A person doesn't have to be a millionaire to leave a legacy. It can be something as simple as passing on a tradition or skill to keep in the family.

Ageing

This is all about making choices and having some control over planning for yourself and your partner whilst able.

- Care and Support

- Roles and responsibilities

This area of planning is overlooked by many people and in many cases the choices and planning is done by the children.

Regardless of how well people manage their physical and mental health and well being, as people get older they will need assistance in some form or another. This can be assistance at home or a need to go into a nursing home.

This is complex, bureaucratic, expensive, and the quality of care variable. Pro active planning means better choices.

Physical symptoms of ageing may force a change where you become more reliant on others for help or they may become more reliant on you.

What is needed is to understand and accept this inevitability, and proactively plan for it. This means making arrangement for others to be able to take over certain tasks and chores if necessary, without undue stress or disruption to family.